高级算法 (Fall 2019)/Concentration of measure: Difference between revisions

imported>Etone |

imported>Etone No edit summary |

||

| Line 215: | Line 215: | ||

:<math>n\cdot \Pr\left[Y_1>2e\frac{m}{n}\right] = n\cdot \Pr\left[Y_1>2e\mu\right]\le \frac{1}{n}</math>. | :<math>n\cdot \Pr\left[Y_1>2e\frac{m}{n}\right] = n\cdot \Pr\left[Y_1>2e\mu\right]\le \frac{1}{n}</math>. | ||

Therefore, for <math>m\ge n\ln n</math>, with high probability, the maximum load is <math>O\left(\frac{m}{n}\right)</math>. | Therefore, for <math>m\ge n\ln n</math>, with high probability, the maximum load is <math>O\left(\frac{m}{n}\right)</math>. | ||

= Martingales = | |||

"Martingale" originally refers to a betting strategy in which the gambler doubles his bet after every loss. Assuming unlimited wealth, this strategy is guaranteed to eventually have a positive net profit. For example, starting from an initial stake 1, after <math>n</math> losses, if the <math>(n+1)</math>th bet wins, then it gives a net profit of | |||

:<math> | |||

2^n-\sum_{i=1}^{n}2^{i-1}=1, | |||

</math> | |||

which is a positive number. | |||

However, the assumption of unlimited wealth is unrealistic. For limited wealth, with geometrically increasing bet, it is very likely to end up bankrupt. You should never try this strategy in real life. | |||

Suppose that the gambler is allowed to use any strategy. His stake on the next beting is decided based on the results of all the bettings so far. This gives us a highly dependent sequence of random variables <math>X_0,X_1,\ldots,</math>, where <math>X_0</math> is his initial capital, and <math>X_i</math> represents his capital after the <math>i</math>th betting. Up to different betting strategies, <math>X_i</math> can be arbitrarily dependent on <math>X_0,\ldots,X_{i-1}</math>. However, as long as the game is fair, namely, winning and losing with equal chances, conditioning on the past variables <math>X_0,\ldots,X_{i-1}</math>, we will expect no change in the value of the present variable <math>X_{i}</math> on average. Random variables satisfying this property is called a '''martingale''' sequence. | |||

{{Theorem | |||

|Definition (martingale)| | |||

:A sequence of random variables <math>X_0,X_1,\ldots</math> is a '''martingale''' if for all <math>i> 0</math>, | |||

:: <math>\begin{align} | |||

\mathbf{E}[X_{i}\mid X_0,\ldots,X_{i-1}]=X_{i-1}. | |||

\end{align}</math> | |||

}} | |||

Revision as of 05:59, 8 October 2019

Chernoff Bound

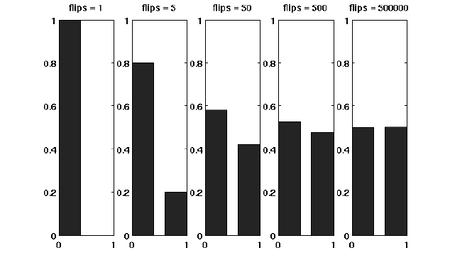

Suppose that we have a fair coin. If we toss it once, then the outcome is completely unpredictable. But if we toss it, say for 1000 times, then the number of HEADs is very likely to be around 500. This phenomenon, as illustrated in the following figure, is called the concentration of measure. The Chernoff bound is an inequality that characterizes the concentration phenomenon for the sum of independent trials.

Before formally stating the Chernoff bound, let's introduce the moment generating function.

Moment generating functions

The more we know about the moments of a random variable

Definition - The moment generating function of a random variable

- The moment generating function of a random variable

By Taylor's expansion and the linearity of expectations,

The moment generating function

The Chernoff bound

The Chernoff bounds are exponentially sharp tail inequalities for the sum of independent trials.

The bounds are obtained by applying Markov's inequality to the moment generating function of the sum of independent trials, with some appropriate choice of the parameter

Chernoff bound (the upper tail) - Let

- Then for any

- Let

Proof. For any where the last step follows by Markov's inequality.

Computing the moment generating function

Let

We bound the moment generating function for each individual

where in the last step we apply the Taylor's expansion so that

Therefore,

Thus, we have shown that for any

For any

The idea of the proof is actually quite clear: we apply Markov's inequality to

We then proceed to the lower tail, the probability that the random variable deviates below the mean value:

Chernoff bound (the lower tail) - Let

- Then for any

- Let

Proof. For any For any

Useful forms of the Chernoff bounds

Some useful special forms of the bounds can be derived directly from the above general forms of the bounds. We now know better why we say that the bounds are exponentially sharp.

Useful forms of the Chernoff bound - Let

- 1. for

- 2. for

- Let

Proof. To obtain the bounds in (1), we need to show that for To obtain the bound in (2), let

Applications to balls-into-bins

Throwing

Now we give a more "advanced" analysis by using Chernoff bounds.

For any

Let

Then the expected load of bin

For the case

Note that

The

When

Let

Thus,

Applying the union bound, the probability that there exists a bin with load

Therefore, for

The

When

We can apply an easier form of the Chernoff bounds,

By the union bound, the probability that there exists a bin with load

Therefore, for

Martingales

"Martingale" originally refers to a betting strategy in which the gambler doubles his bet after every loss. Assuming unlimited wealth, this strategy is guaranteed to eventually have a positive net profit. For example, starting from an initial stake 1, after

which is a positive number.

However, the assumption of unlimited wealth is unrealistic. For limited wealth, with geometrically increasing bet, it is very likely to end up bankrupt. You should never try this strategy in real life.

Suppose that the gambler is allowed to use any strategy. His stake on the next beting is decided based on the results of all the bettings so far. This gives us a highly dependent sequence of random variables

Definition (martingale) - A sequence of random variables

- A sequence of random variables